bain capital tech opportunities funding

Edtech healthcare tech logistics tech and e-commerce enablement The continued growth in Indian SaaS funding has attracted an increasingly diverse investor base. Since our founding in 1984 weve applied our insight and experience to organically expand into several asset classes including private equity.

When I Work Secures 200 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

More than 95 of private equity investors plan to increase their focus on ESG-related issues in the coming 3 to 5 years encouraged by investor demand according to our 2022 Asia.

. The segment will see significant investment and is projected to grow to a. The ranking revealed that total revenues for the top 750 fell to 1031 trillion in 2020 from 1036 trillion in 2019. Analytics offers more than 1000 unique profiles on these investment groups providing details for each one.

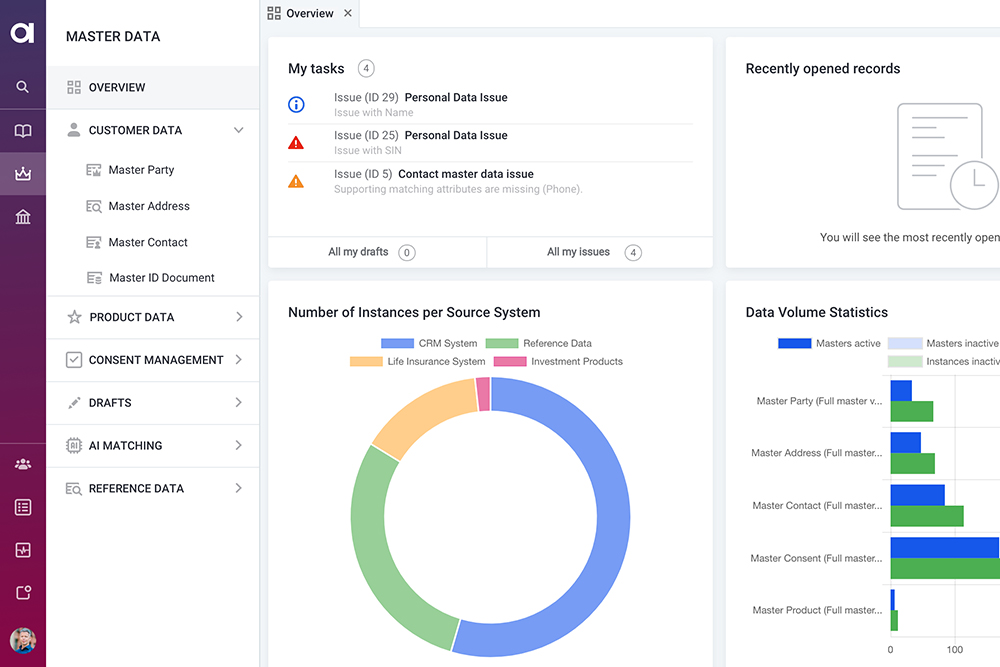

Ataccama Receives 150 Million Growth Investment from Bain Capital Tech Opportunities. Hutchins is moving to Ropes Gray as a partner in its private equity practice. India has witnessed the emergence of SaaS-focused funds combined with growing interest from new investor categories such as corporate venture.

Innovation August 27 2022. STRESS-FREE FUNDING ROUND FOR WELLBEING TECH FIRM Thrive. The worlds biggest family businesses saw revenues and employee numbers fall in the latest Family Capital ranking of the top 750 in the world.

A general counsel at Bain Capital David M. Bain Capital Tech Opportunities. Analytics is a unique and dynamic database on global Family Offices Principal Investment Offices and Family Capital.

The TechWatch Media Group audience is driving progress and innovation on a global scale. Veritas Capital and Evergreen Coast Capital to Acquire Cubic for 7000 Per Share. News analysis and comment from the Financial Times the worldʼs leading global business publication.

As of 2022 the firm managed approximately 160 billion of investor capital. With its regional media properties New York Tech London Tech LA Tech Paris Tech Boston Tech TechWatch Media Group is the highway for technology and entrepreneurshipThere are a number of options to reach this audience of the worlds most. Vertical business software.

TORONTO and BOSTON June 22 2022 - Ataccama a leading unified data management platform provider today announced it has received 150 million in growth capital from Bain Capital Tech Opportunities representing a minority investment in the company. Bain Capital LP is one of the worlds leading private investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. Bain Capital is an American private investment firm based in BostonIt specializes in private equity venture capital credit public equity impact investing life sciences and real estateBain Capital invests across a range of industry sectors and geographic regions.

Our Flagship Event Ascent Annual. The renewables sector generated big investments including 3 billion in funding for SVolt and Sequoia Capitals 1 billion investment in Chinas Envision Group. GoCardless secures 718 million Series F investment led by Bain Capital Ventures.

London 16082022 Deep-tech energy innovator. The Capital August 27 2022 Prime Super and YES Groups Acquisition of. The firm was founded in 1984 by.

Sie Ventures is determined to plug the funding gap for early-stage female founders. Spectrum Equity a growth equity firm focused on software and data services and 22C Capital have led a 200 million strategic investment in RapidRatings a provider of financial health data and analytics. Life sciences double impact and tech opportunities teams in North.

February 08 2021. Norton Rose Fulbright expands innovation and tech capabilities in Germany. Led by IQ Capital.

CUB today announced that it has entered into a definitive agreement with an affiliate of Veritas Capital under which Veritas and Evergreen Coast Capital Corporation an affiliate of Elliott Investment Management LP will acquire Cubic for. The funding will enable IONATE to deliver its game-changing control technology to real-world power systems. Announced its fully underwritten 30 million capital raising.

We believe their backgrounds will allow us access to proprietary investment opportunities and position us to successfully complete an initial business combination. Total Equity Funding Lead Investors Include Country Continent. They aim to address the shortfall in venture-capital funding and provide investors with better access to.

According to a Bain report last year private equity and venture capital investments in the agritech segment increased to 329 million in 2020 from 296 million in 2019. RapidRatings works to transform how companies manage the supply chain and third-party risk through its financial health service. Other existing investors like Arkam Ventures Eximius Ventures Force Ventures LetsVenture Rocketship Venture Capital and WEH Ventures also participated in the.

Kohlberg Kravis Roberts Japan Sequoia Capital. The Ascent Annual Conference is where our audiences converge for a State of the Union in SaaSThis immersive 2-day SaaS conference will be convening 1500 invite-only CEO CRO CMO and VPs at 20M or larger companies to enjoy 100 peer-to-peer roundtables 1000 1-on-1 meetings 30 hours of Industry Leading content 1 Gala. Misbah Ashraf Nischay AG founders Jar Jar a fintech app for savings said it has raised 226 million in its Series B funding round led by existing investor Tiger Global at a valuation of 300 million.

If a change occurs KKRs business financial condition liquidity and results of operations including but not limited to assets under management fee paying assets under management after-tax distributable earnings capital invested syndicated capital uncalled commitments cash and short-term investments fee related earnings fee and. We have flexibility to be able to offer a target business innovative funding options in structuring a transaction and funding future business growth. Negotiation and closing of the 15 million Series A funding round of Pharrowtech.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/NHK6RQ4QO5KJTFZTBMJR7OL44U.jpg)

Exclusive Bain Capital Raises 11 8 Billion For New Flagship Fund Reuters

Bain Capital Specialty Finance Bain Capital Bdc

David Shaughnessy Vice President Bain Capital Linkedin

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Our People Bain Capital Tech Opportunities

Hudl The Global Leader In Sports Performance Analysis Solutions Announces Growth Investment From Bain Capital Tech Opportunities

When I Work Secures 200 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Bain Capital Investor Profile Portfolio Exits Pitchbook

Bain Capital Tech Opportunities Fund Ii Profile Investments Returns Pitchbook

Leantaas Announces Growth Investment By Bain Capital Private Equity To Fuel Leading Ai Driven Platform For Hospitals To Achieve Operational Excellence Bain Capital

Foundation For Business Equity Announces 2 5 Million Commitment From Bain Capital To Assist And Accelerate Black And Latinx Owned Businesses Bain Capital

Bain Capital Bets Big On Value Based Care Drug Development And Healthcare It Pe Hub

Bain Capital To Buy Deltatre From Bruin Capital In Digital Media Deal Sportico Com

When I Work Secures 200 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Our People Bain Capital Tech Opportunities

Hudl The Global Leader In Sports Performance Analysis Solutions Announces Growth Investment From Bain Capital Tech Opportunities

Ataccama Receives 150 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Bain Capital Life Sciences Crunchbase Company Profile Funding